I was recently catching up with an old client over coffee. His job always fascinated me, and I had always wanted to fully understand what he does.

As we spoke, I learned that he heads the private treasury of one of India’s leading conglomerates. He broke down how these corporate treasuries work, and I was struck by just how complex and fascinating the world of corporate finance can be. It’s like these companies have their own mini-banks, managing funds, liquidity, and risk all in-house.

This sparked my curiosity as to how India is building its own financial backbone to support such sophisticated operations. Gujarat’s GIFT City is at the heart of this transformation.

The government and regulators are working together through the International Financial Services Centres Authority (IFSCA) to create a strategic hub that promotes financial markets and services.

With attractive incentives and a forward-looking vision, the government is encouraging both Indian and global conglomerates to consider GIFT City for their treasury and commodity trading activities.

In this newsletter, I thought I’d break down how corporate treasuries actually work and why they matter in the context of India’s financial evolution.

We’ll cover:

- What are GRCTCs?

- How they’re structured, key considerations, and the setup process

- How do they benefit companies

- How Gujarat’s GIFT City is making India a hub for these centres

Let’s get started.

So what exactly is a GRCTC?

A Global or Regional Corporate Treasury Centre (GRCTC) acts as an internal banking and commodity trading hub for multinational companies. Its main goal is to centralise fund management, support commodity trading, manage costs, and improve the use of financial resources across the group.

Each large multinational conglomerate (like Siemens, Tata, General Electric, Samsung, etc.) usually has at least one global treasury centre, and sometimes multiple regional centres in key financial hubs like Singapore, London, New York, and Hong Kong.

A GRCTC typically:

- Manages group-level financing and intercompany lending.

- Consolidates cash and liquidity.

- Offers a centralised platform for financial, trading, and hedging activities.

- Helps companies negotiate better terms with banks and financial counterparties.

- Enhances transparency, consistency, and cost efficiency by standardising processes and policies.

In some cases, they also handle operational areas like commodity procurement, logistics, settlements, and accounting, giving them comprehensive oversight of trade-related activities.

After the 2008 financial crisis, many companies pushed towards better cost control and reduced reliance on external funding. Now, many firms focus on mobilising internal funds through in-house banking setups.

Corporate treasuries have evolved to provide a holistic role to conglomerates. While they once focused solely on essential financial activities, today they act as internal advisors, supporting strategic planning, financial reporting, and risk management.

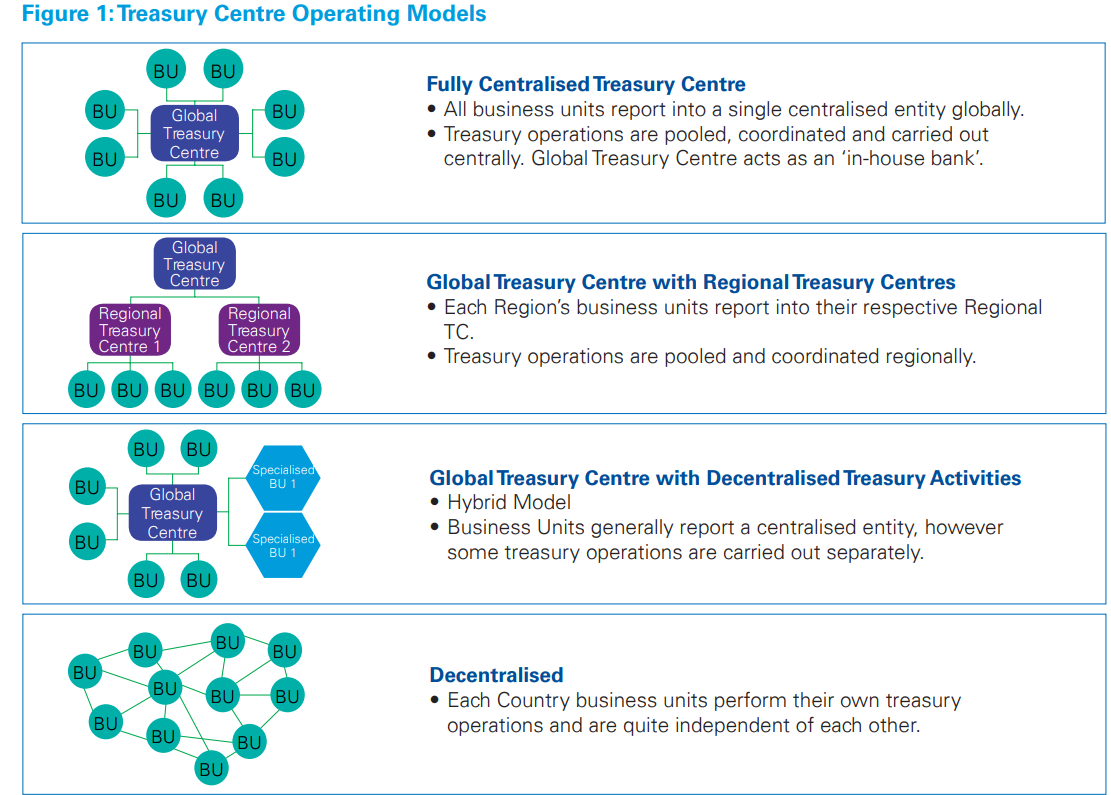

With globalisation and technological advances, many companies now prefer centralised treasury models. In fact, here are a few GRCTC operating models:

What factors go into deciding a GRCTC?

When establishing a GRCTC, the company has to make an important decision about selecting the best location. Here are some of the key factors:

- Time zone: A time zone that aligns with the company’s headquarters helps ensure smoother transactions and better coordination between the main office and the GRCTC.

- Proximity to vendors: Being close to vendors and suppliers makes it easier to manage trade relationships and optimise supply chain financing. For example, a company importing primarily from the Far East might set up a GRCTC in East Asia to strengthen ties with those partners.

- Trade and financing support: A location that supports both direct and merchant trading, along with associated financing, can significantly enhance the effectiveness of a GRCTC.

- Setup costs: The cost of establishing a GRCTC varies by location. More developed commercial centres often come with higher setup costs, so companies need to weigh this carefully.

Regulatory environment: A favourable regulatory environment is essential. It reduces hurdles, speeds up decision-making, and helps manage financial risks effectively. Clear regulations also make it easier to optimise capital allocation.

How are they structured?

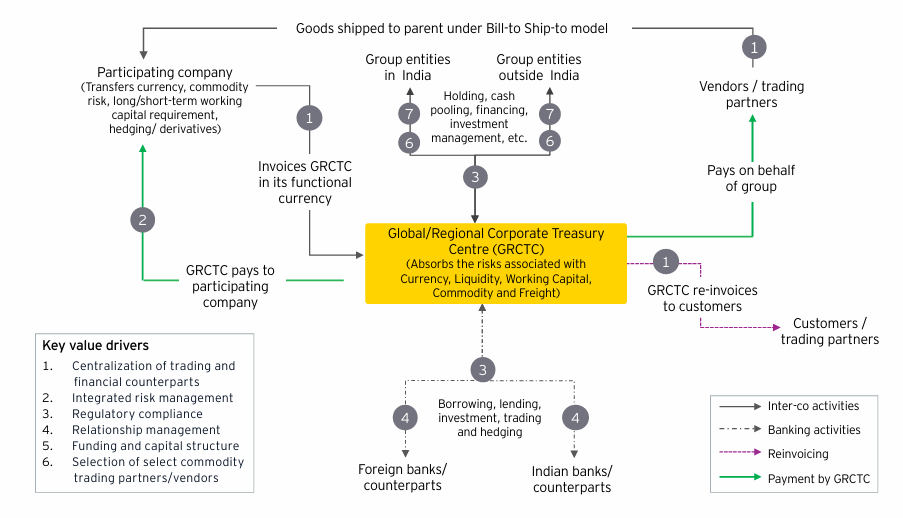

A GRCTC handles several services for the main company, its subsidiaries, vendors, and other stakeholders. This helps ensure smooth and efficient money management, trading, and risk management.

Here’s a look at how GRCTCs typically function:

Advantages of GRCTCs

Setting up a Global or Regional Corporate Treasury Centre (GRCTC) offers several strategic benefits for multinational corporations. Here are the key advantages:

Setting up a Global or Regional Corporate Treasury Centre (GRCTC) offers several strategic benefits for multinational corporations. Here are the key advantages:

- Group-wide transaction netting and cash visibility: A GRCTC improves visibility over cash flows across multiple currencies and banking partners. It helps net inflows and outflows between group entities, reducing the number of transactions and simplifying operations.

- Corporate tax incentives: Many regions offer tax benefits to attract treasury centres, such as reduced tax rates, tax holidays, and exemptions on certain transactions. These incentives lower costs and improve the financial position of the company.

- Access to financial partners: Being close to key financial hubs makes it easier to secure competitive financing and negotiate better terms with banks.

- Ease of doing business: Preferred GRCTC locations often have supportive regulatory environments, reliable infrastructure, and access to banks and traders.

- Commodity trading and hedging efficiency: GRCTCs in financial hubs offer better access to global commodity markets, exchanges, and logistics partners, helping to reduce transaction costs and improve trade execution.

Why GIFT City is an Ideal Location for GRCTCs

GIFT City in India was developed as a smart city to provide a full range of financial services—like banking, insurance, capital markets, and asset management—through its International Financial Services Centre (IFSC). It’s designed to cater to businesses operating in foreign currencies rather than Indian rupees.

There has been keen interest in establishing GRCTCs within GIFT City, with the IFSC offering tax benefits and regulatory concessions that encourage Indian and global corporations to set up a presence there, subject to eligibility criteria.

Here is a list of some of the major treasury activities and services offered in GIFT City:

centres in GIFT IFSC” report

One of the main advantages of setting up a GRCTC in GIFT City is the tax incentives and regulatory support offered by the IFSC. These incentives lower costs and ease compliance for both Indian and global companies. The IFSCA’s clear frameworks cover key activities like FX risk management, cash management, fundraising, intra-group financing, and commodity trading.

GIFT City is also positioning itself as a global commodity trading hub. It benefits from favourable regulations and proximity to trade and logistics partners. The city aims to provide a complete suite of trade finance solutions—including factoring, forfaiting, and invoice discounting—and is working to attract trade credit and freight insurance providers.

Recent guidelines have further clarified how GRCTCs can operate, covering activities like re-invoicing centres, freight hedging, and cash pooling. This clarity helps companies plan and manage their treasury operations more effectively.

Conclusion

GRCTCs are a great way for companies to manage their conglomerate finances effectively. By centralising fund management, liquidity, and risk, they help improve transparency, consistency, and efficiency while also protecting against market volatility.

GIFT City is emerging as an ideal destination for setting up these global treasuries. With supportive regulations, tax incentives, and a growing financial ecosystem, it offers businesses a cost-effective, flexible, and strategic location for their treasury operations.

India’s financial ecosystem is evolving rapidly. With the government, regulators, and financial centres working together, the country is becoming a holistic and integrated financial hub, poised to rank among the world’s top destinations for treasury and financial services.

Podcast: Wealth Insights

Before I sign off for the week, I also wanted to share something we’re doing at Investza.

We recently launched a podcast series, Wealth Insights, where I speak with India’s top fund managers. They share their journeys, their views on wealth, and how investors should think about wealth creation.

I began this series with the legendary Radhika Gupta, CEO at Edelweiss Mutual Fund, followed by our industry veteran Kalpen Parekh,, CEO & MD at DSP Mutual Fund.

In the latest episode, I sit down with Vijay Mantri, Co-Founder and Chief Investment Strategist at JRL Money.

Vijay candidly shares:

- How young investors should view money, risk, and wealth

- Why equity is the most misunderstood yet essential asset

- The critical role of financial advisors in wealth management

- Simple yet powerful personal finance principles

Check out the episode now!

Disclaimer: The information contained herein is for informational purposes and should not be interpreted as soliciting, advertising, or providing any advice. Securities investments are subject to market risks, please consult a professional before making investment decisions.